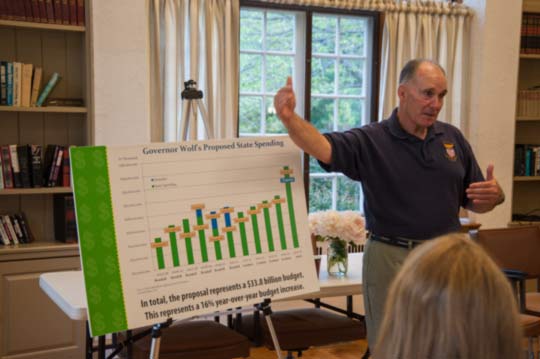

Gov. Tom Wolf’s proposed budget calls for a $4.5 billion spending increase, raising the sales tax to 6.6 percent and income taxes to 3.7 percent, according to a presentation by state Rep. Stephen Barrar.

“That’s a pretty dramatic tax increase,” said the 160th Legislative District’s Republican representative, now in his 10th term in office.

He thinks the governor will not get what he wants.

“My opinion is the only tax the governor is going to get is the Marcellus Shale tax…I’ll vote for a 3.5 percent Marcellus Shale tax increase, but I’m certainly not voting for a 7.4 percent, which would make us the second highest natural gas tax in the nation.”

Barrar, whose comments came during a town hall meeting in Pennsbury Township on May 27, said a 7.4 percent increase would be harmful to the industry, which he referred to as “the only economic bright spot in Pennsylvania in the last five years.”

“If there’s something that’s fueling the state’s economy, why would you go shoot it in the head and kill it with the second highest tax rate in the nation?”

Barrar added that there’s already a 2 percent impact fee on Marcellus Shale, resulting in $700 million per year collected by the state. A 3.5 percent increase would add another $700 million, he said.

He said he’d like to see the increased revenue used to eliminate some already existing taxes rather than on additional spending.

Among the taxes he’d like to see eliminated is the 4.5 percent inheritance tax, which taxes money left to a deceased person’s children.

“Our inheritance tax, in my opinion, is the most immoral tax we have because we tax you at a higher rate when you’re dead. You’re not here to complain about it,” he said.

Whenever there’s talk about the state budget, the topic usually turns toward education funding and the conversation during this meeting was no exception.

The governor’s proposed budget, Barrar said, calls for spending an additional $1 billion for education. He also said those who claim former Gov. Tom Corbett cut $1 billion from education are lying. That lost money, according to Barrar, was a result of lost federal stimulus money.

“We’re at the highest point in our history when it comes to the amount of money the state puts into education,” Barrar said. “Do we need more money in education? Absolutely. Especially for special education, which is seriously underfunded.”

As he has said before, Barrar wants to change the way schools are funded.

“If your children go to Unionville-Chadds Ford or to Garnet Valley schools, your kids are shortchanged,” he said.

Barrar explained the point, saying schools in those districts get $350 per student from the state, while the state spends more than $10,000 per student in Philadelphia and Chester schools. State and local taxes for public education total $17,000 per student while the national average is $11,000 per student.

He said some districts are spending less than $17,000 and have great results, while others, such as Chester, spend more without good results.

Barrar said 38 percent of school kids in Philadelphia and 42 percent in Chester opt out of regular public schools in favor of charter schools. He likened that to a business losing 38 or 42 percent of its customers.

He proposed a change in the funding formula to offer a baseline for all students, suggesting the state pay $4,000 per student across the commonwealth.

Specifically, he wants to see a shift away from property taxes used to pay for state schools. Instead, the idea is to use sales tax, an income tax, or a combination of both. That, however, is still debated in the legislature.

Barrar told a personal anecdote about buying his first house in 1978, and telling his father he thought taxes were too high. He said his father told him not to worry because the legislature was going to fix the problem in a year. Most of the audience laughed.

He said everyone does want to fix the issue. But “the problem is, everyone has a different idea of what would work,” he said.

Some people want to see an increase in sales taxes, while others want to see an increase in income taxes to pay for public schools.

One proposed bill, HB 76, would shift school funding completely away from property taxes and shift to the others. Barrar said he’s sponsored the bill in two different House sessions, but it’s never received more than 60 votes.

Part of the problem with increasing the sales tax to pay for education, especially in this area, is that consumers will go shop in Delaware. Additionally, the added income tax burden would be “enormous” in areas with already high school taxes, he said.

Barrar added that only about 100 of the state’s 500 school districts would see any serious property tax relief under the governor’s plan, and none of those are in the greater Chadds Ford area school districts: Unionville-Chadds Ford, Garnet Valley and Kennett Consolidated.

“The school districts that get the highest amount of support from the state will get the highest amount of property tax relief because of the way the formula works,” Barrar told members of his constituency. “People in this area will be cheated enormously. You’ll pay a lot more income taxes.”

(Top photo: State Rep. Stephen Barrar makes a point during the town hall meeting.)

(3 votes, average: 3.67 out of 5)

(3 votes, average: 3.67 out of 5)

Comments